This week we have three major central bank meeting, although only the FED is expected to change rates, while the BOJ and the BOE are expected to keep interest rates on hold.

Xem thêm : Mexican Peso Strengthens, Ends the Week on a Positive Note

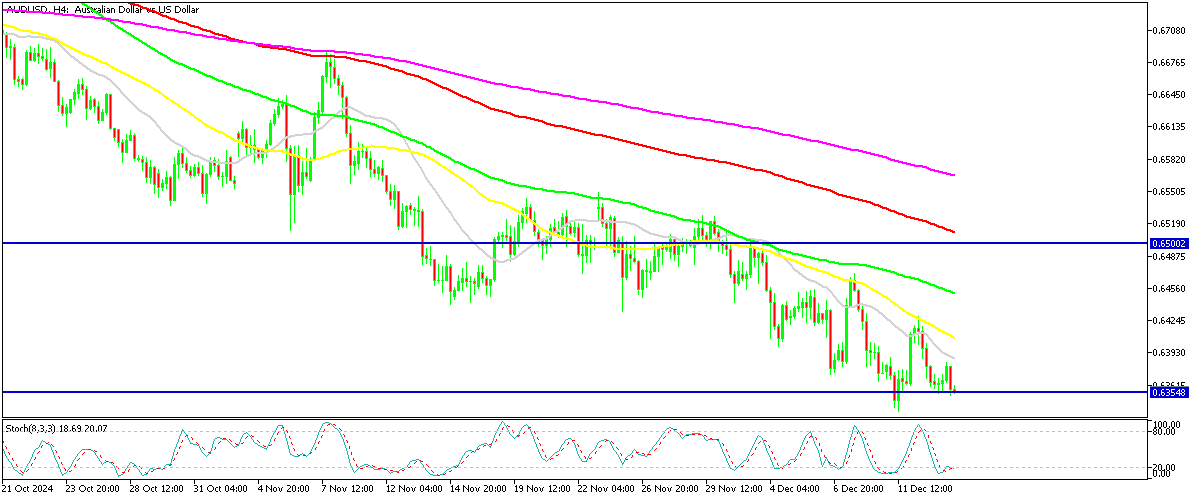

Last week we had three other major central banks holding their meetings, starting with the Reserve Bank of Australia, on Tuesday morning, which held interest rates unchanged once again at 4.35%. However they made some dovish comments which signalled a shift, sending the Australian dollar lower.

The US CPI and PPI inflation reports came on the strong side once again for November, showing that inflation remains sticky, however that didn’t change the odds of this week’s FED rate cut. However the USD continued the upside momentum as treasury yields continued to rise.

The Bank of Canada delivered a 50 basis points (bps) rate cut on Wednesday, taking them from 2.75% to 3.25%, which weighed on the Canadian Dollar. USD/CAD surged to 1.4240s, which is the highest level in 4 years, also helped by the disappointment from the Chinese stimulus. The Swiss National Bank also delivered a surprise 50 bps rate cut, lowering them to 0.50% in an effort to help the Swiss Consumer and the economy.

This Week’s Market Expectations

This week’s economic calendar is packed with key events that could significantly influence market sentiment, particularly central bank decisions from the FOMC, BoJ, and BoE, as well as critical inflation data from the UK, Canada, and the US.

Upcoming Events for the Week:

Monday

- China: Retail Sales and Industrial Production

- Japan/Eurozone/UK/US: Flash PMIs

Tuesday

- UK: Employment Report

- Canada: CPI

- US:

- Retail Sales

- Industrial Production and Capacity Utilization

- NAHB Housing Market Index

Wednesday

- UK: CPI

- US:

- Housing Starts and Building Permits

- FOMC Policy Decision

- New Zealand: Q3 GDP

Thursday

- Japan: BoJ Policy Decision

- UK: BoE Policy Decision

- US:

- Final Q3 GDP

- Jobless Claims

Friday

- Japan: CPI

- China: PBoC Loan Prime Rate (LPR)

- UK: Retail Sales

- Canada: Retail Sales

- US: Core PCE Price Index

Last week we remained loon on the USD dollar continued the slight bullish momentum, helped somewhat by the US CPI consumer and PPI production inflation reports, which leaned on the strong side. We opened 24 trading signals in total, ending the week with 18 winning forex signals and 6 losing ones.

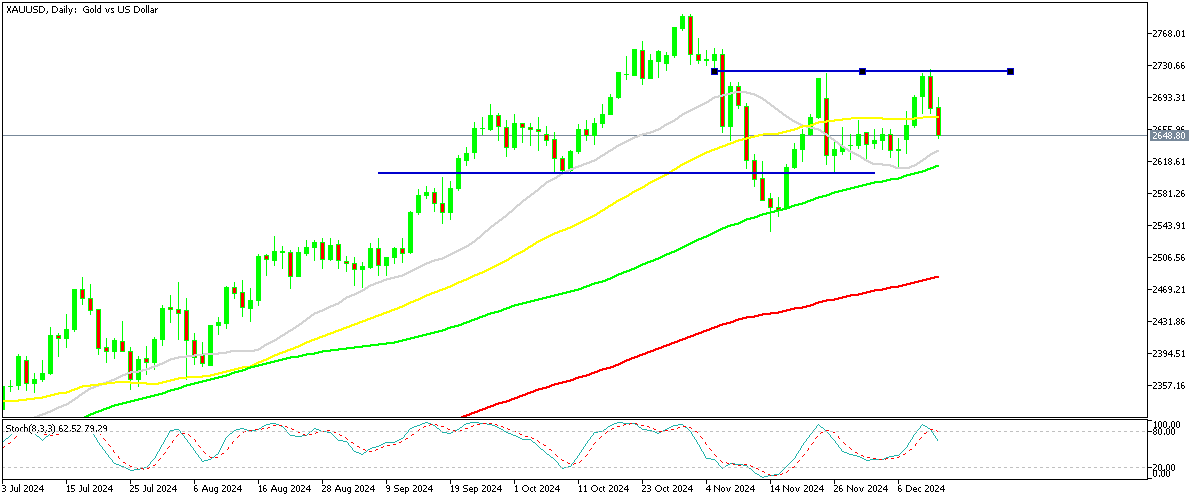

Gold Rejected at November 25 Highs

Gold started to show a strong recovery early last week, rising $100 from its lows. The US CPI inflation report supported the precious metal, helping it reclaim the $2,700 level while forming three consecutive bullish candlesticks. However XAU/USD failed to break above the November 25 high above $2,720 and retreated more than $7-00 lower in the last two days of last week. Gold is now testing support at $2,640s.

XAU/USD – Daily Chart

AUD/USD Faces the Support at 0.6350

Xem thêm : Forexlive Asia-pacific FX news wrap for Monday 30 December 2024 – holiday trade persists

The Australian dollar (AUD/USD) faced selling pressure after the Reserve Bank of Australia (RBA) kept interest rates unchanged but maintained a dovish tone at its latest meeting. The currency temporarily dropped below the 2024 support level of 0.6350, reaching 0.6336 before rebounding by nearly 1 cent following the release of stronger-than-expected unemployment data. However sellers returned as MAs continue to provide resistance, closing the week at 06350.

AUD/USD – H4 Chart

Cryptocurrency Update

Bitcoin Climbs Above $100K Again

BTC/USD – Daily chart

Ethereum Shying Out at $4,000 Again

Ethereum also rebounded from a decline below $3,000 to trade near $4,000. It remains above the $3,500 mark and its 50-day SMA, reflecting growing investor confidence. However, Ethereum struggled to break $4,000 yesterday and has since pulled back slightly.

ETH/USD – Daily chart

Nguồn: https://cumlaude.fun

Danh mục: News