- Euro Sinks Below $1.04 as Light Christmas Trading Favors US Dollar — TradingView News

- British Pound Technical Forecast: GBP/USD, GBP/JPY, EUR/GBP

- ETH/USD Forecast Today 27/12: Struggles Below $3,600 (Chart)

- Taiwan forex reserves down at year-end on central bank intervention

- Signs of a USDCAD Reversal

- US data on sales, business activity and GDP growth all revealed a robust economy.

- Canada’s inflation rose more than expected, but sales missed forecasts.

- Fed policymakers forecast fewer-than-expected rate cuts in 2025.

The USD/CAD weekly forecast shows a divergence in policies between the Fed and the BoC that has hurt the loonie.

Bạn đang xem: USD/CAD Weekly Forecast: Fed-BoC Divergence Triggers Bulls

Ups and downs of USD/CAD

The loonie had a bullish week amid a mix of data from Canada and the US. US data on sales, business activity, and GDP growth all revealed a robust economy that needs restrictive monetary policy. Meanwhile, in Canada, inflation rose more than expected, but retail sales missed forecasts.

-Are you looking for the best AI Trading Brokers? Check our detailed guide-

Meanwhile, the FOMC meeting gave the dollar a boost as policymakers forecasted fewer-than-expected rate cuts in 2025. The outlook especially weighed on the loonie since the Bank of Canada has maintained an aggressive easing cycle, which might continue in 2025.

Next week’s key events for USD/CAD

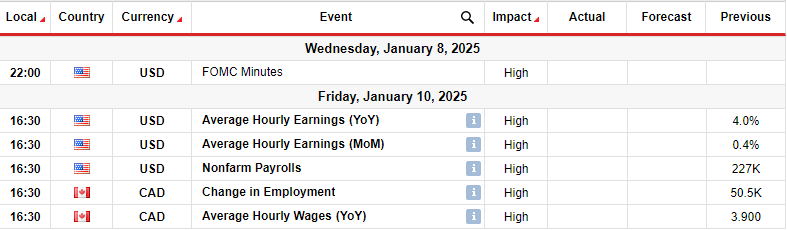

In 2025, traders will study major reports showing employment change in the US and Canada. Additionally, the FOMC meeting minutes will give insight into Fed monetary policy.

Notably, the US nonfarm payrolls report will show whether there was a surge in employment in December. At the same time, it will show the state of unemployment, which increased in November. An upbeat report will signal economic resilience, reducing Fed rate cut bets and boosting the dollar. On the other hand, soft figures might increase rate cut bets and weigh on the greenback.

Meanwhile, Canada’s economy has been on a downtrend, pushing the Bank of Canada to cut rates aggressively in 2024. Weak employment figures will raise expectations for more rate cuts, which will sink the loonie.

USD/CAD weekly technical forecast: Uptrend pauses at the 1.4450 resistance

On the technical side, the USD/CAD price has paused its rally at the 1.4450 resistance level. However, the bullish bias remains strong since the price trades well above the 22-SMA, with the RSI in the overbought region. Therefore, the pause might allow the price to retest the 22-SMA before continuing higher.

Xem thêm : US Dollar Ends the Year on a Strong Note

–Are you interested in learning more about Canadian forex brokers? Check our detailed guide-

Since bulls broke above the 22-SMA, the price has traded in a higher high, higher low pattern, indicating a developed uptrend. At the same time, it has respected the 22-SMA as support. Meanwhile, the RSI has stayed above 50 in bullish territory.

In the new year, USD/CAD might continue its uptrend after a pullback to retest the 1.4200 key level or the 22-SMA support.

Looking to trade forex now? Invest at eToro!

67% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money.

Nguồn: https://cumlaude.fun

Danh mục: News