- The Fed and the Reserve Bank of Australia will remain cautious this year.

- US unemployment claims unexpectedly fell, indicating a resilient labor market.

- Business activity in the US manufacturing sector improved.

The AUD/USD weekly forecast suggests little policy easing in the US and Australia this year, which could result in a neutral bias.

Bạn đang xem: AUD/USD Weekly Forecast: Neutral Bias Amid Subtle Policy Shifts

Ups and downs of AUD/USD

The AUD/USD pair fluctuated this week and ended nearly flat as traders adjusted to the outlook for the new year. The Fed and the Reserve Bank of Australia will remain cautious this year. The Fed has projected only two rate cuts, while the RBA might not start cutting until the second quarter due to still-high inflation.

–Are you interested in learning more about STP brokers? Check our detailed guide-

Xem thêm : China’s new forex rules require banks to tighten scrutiny on cryptocurrency trades

At the same time, market participants paid attention to US data, which showed that unemployment claims unexpectedly fell, indicating a resilient labor market. At the same time, business activity in the manufacturing sector improved but remained in contraction.

Next week’s key events for AUD/USD

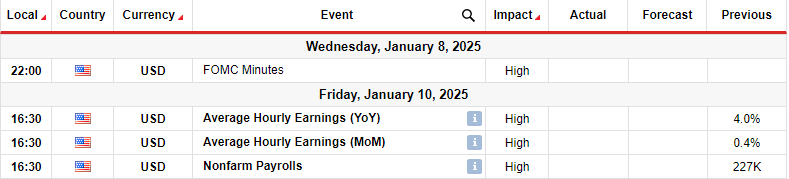

Next week, investors will focus on US reports, including FOMC minutes and monthly employment figures. The FOMC minutes will show how the Fed decided to cut interest rates in December. At the same time, it will contain clues for future moves. During the December meeting, the Fed projected only two rate cuts this year, causing a big decline in the AUD/USD pair.

Moreover, traders will pay attention to the first nonfarm payrolls report for the year. The employment figures will continue shaping the outlook for Fed rate cuts in 2025.

AUD/USD weekly technical forecast: Small-bodied candles signal exhaustion

On the technical side, the AUD/USD price has steadied near the 0.6202 support level. After a sharp fall, bears are showing some exhaustion at this level. The price has maintained a bearish trend since it broke below the 22-SMA, making lower highs and lows. This pattern has remained for long, allowing AUD/USD to break below major support levels.

Xem thêm : GBP/USD Forecast: Dollar Surges Amid Hawkish FOMC

–Are you interested in learning more about forex bonuses? Check our detailed guide-

However, after the recent swing low, bears have shown some weakness at the 0.6202 level. The price is making small-bodied candles, and the RSI has made a slight bullish divergence. If this plays out next week, the price will likely rebound to the 22-SMA resistance.

However, the bearish trend will remain intact if the price stays below the SMA. Bears will seek to make a new low below the 0.6202 support. On the other hand, a break above the SMA would signal a shift in sentiment, allowing AUD/USD to retest the 0.6450 resistance.

Looking to trade forex now? Invest at eToro!

68% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you can afford to take the high risk of losing your money

Nguồn: https://cumlaude.fun

Danh mục: News