The week of Christmas is typically a snooze fest in the forex world. With many institutional traders enjoying their eggnog and holiday cookies, market liquidity is thin, and trading ranges are narrow.

Bạn đang xem: Year-End Forex Playbook: Tight Ranges, Big Opportunities?

Here are some valuable tips, terms explained and prop firm news for December 26, 2024:

What to Expect from Year-End Forex Trading

As we approach the holiday season, forex markets tend to take on a different rhythm. If you’re planning to trade during the last two weeks of the year, here’s what you need to know to navigate the unique dynamics of this period. Spoiler alert: it’s all about tight ranges and subtle opportunities. Let’s dive in!

Christmas Week: Calm Before the Storm?

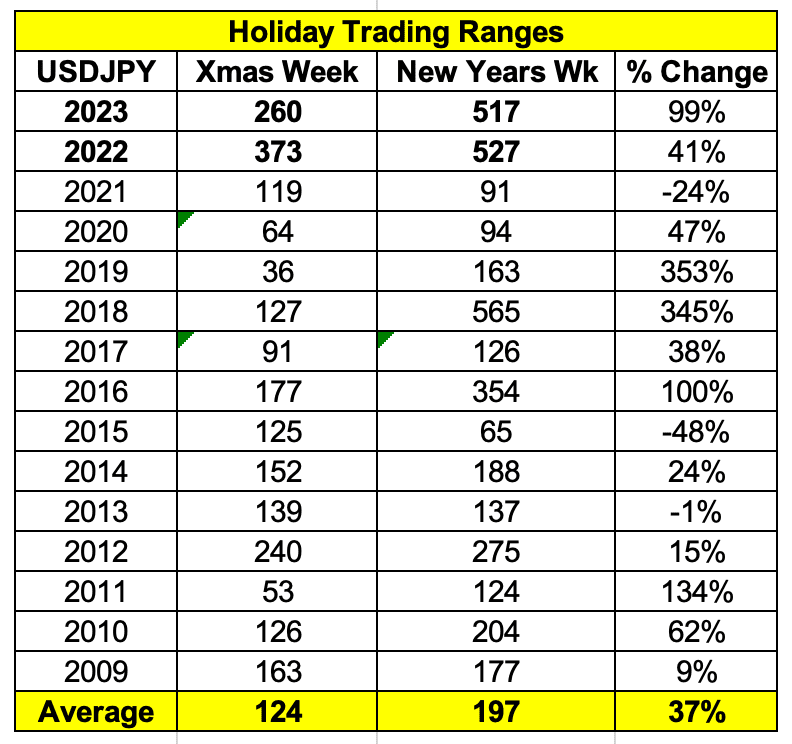

The week of Christmas is typically a snooze fest in the forex world. With many institutional traders enjoying their eggnog and holiday cookies, market liquidity is thin, and trading ranges are narrow. For and , you’re looking at a typical range of about 100 pips for the week.

Xem thêm : France Downgraded – Action Forex

This makes Christmas week perfect for range-bound strategies. Oscillators like RSI or Bollinger Bands can shine here, helping you spot those bounces off support and resistance levels.

New Year’s Week: A Different Story?

New Year’s week can sometimes bring more action, but this year’s calendar is putting a damper on things. In 2023 and 2022, USD/JPY saw massive 500-pip moves during this period because New Year’s Day fell on a weekend or a Monday, giving traders almost an entire week to make things interesting.

This year, New Year’s Day lands on a Wednesday, meaning trading will be interrupted midweek, with most traders still off enjoying their holidays.

As a result, the trading range is expected to be more like 100 pips—in line with Christmas week. So, don’t expect fireworks —it’s going to be more like sparklers.

No Big Breakouts, Just Subtle Moves

Xem thêm : Forex Signals Brief January 10: Strong NFP Would Accelerate USD Uptrend

With lighter trading volumes and a lack of major economic data releases, it’s unlikely we’ll see any big breakouts. Instead, the market will probably be stuck in familiar ranges. For traders, this means range trading is the name of the game.

If you’re the type who loves to hunt for trends, you might want to sit this one out. But if you enjoy steady, predictable moves, this could be your time to shine.

Dollar Profit-Taking: A Year-End Twist?

Here’s something to keep on your radar: the has had a stellar year, thanks to higher and a strong economy. But as we close out 2024, we could see some profit-taking on long-dollar positions.

Fund managers often like to lock in profits before year-end, which might create some softness in the dollar. While it probably won’t lead to any huge moves, it could offer short-term opportunities—especially in pairs like EUR/USD and USD/JPY.

Key Takeaways

- Christmas week is all about tight ranges—focus on range-bound strategies.

- New Year’s week won’t be as wild as 2023 or 2022. Expect a similar range to Christmas week (~100 pips).

- Profit-taking on US dollar positions could create some subtle trading opportunities.

So, grab your hot cocoa, cozy up, and trade smart this holiday season. No need to swing for the fences—this is the time to stay disciplined and take what the market gives you. Happy trading!

Nguồn: https://cumlaude.fun

Danh mục: News